Exemplar Tech Ecosystems: Manchester

Home to 1,213 active high-growth companies, Greater Manchester accounts for 3.6% of the UK’s total high-growth population.

14 October 2021 • 9 minute read

Over 30% of these companies operate in the technology sector. Manchester’s technology ecosystem makes this possible. The city’s population base and commercial density combined with partnerships between public and private organisations create a nurturing environment for early-stage and scaling technology companies.

New and more established tech companies can source investment from investors such as Mercia Asset Management or via GC Angels — both of which are highly active investors in the Greater Manchester area. In 2020, Manchester-based technology companies raised £216m in equity investment, down from the record £316m raised in 2019 but still an impressive total in a year that was certainly not business-as-normal.

Beyond investment, Manchester-based companies can access support from local incubators, accelerators and universities. An important source of support is the Manchester Science Partnership which is a partnership between the Manchester City Council, the University of Manchester and the Salford City Council among others. The partnership provides support via two campuses run by Bruntwood SciTech that offer incubation services and lab facilities.

Manchester: Headline stats

206k

active companies

1,213

active high-growth companies

388

active high-growth tech companies

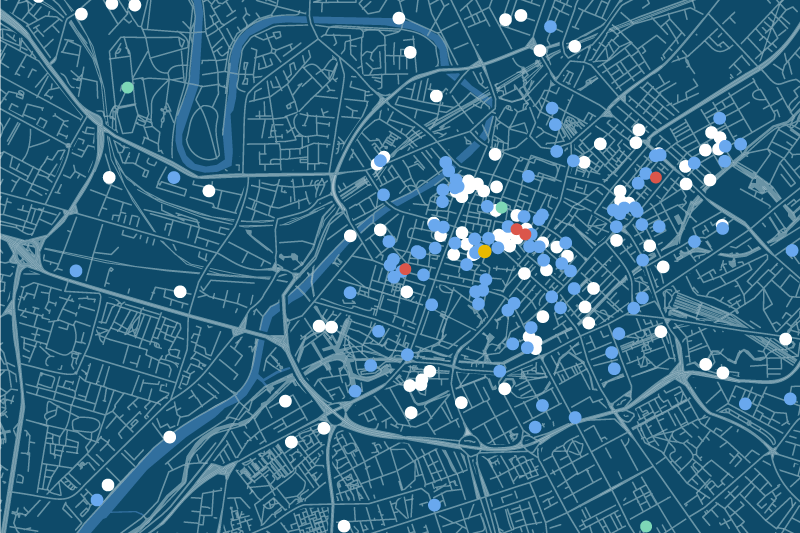

Map of Manchester: Key ecosystem features (2021)

The majority of the high-growth companies in Greater Manchester are located in the Manchester local authority area, although Trafford, Stockport and Salford also play host to significant high-growth company populations.

Tech investment

Between 2011 and 2020, £2.4b of equity investment across 1,421 deals was secured by companies in Greater Manchester, including 864 deals into tech companies worth £1.7b. With nearly 200 deals in each year, 2017 and 2019 both saw over £450m of equity investment and were the peaks of the decade.

Headquartered at Manchester Airport, the Hut Group operates a large number of e-commerce websites selling a huge range of consumer products. Among its 12 rounds of equity fundraising throughout the last 10 years, the company raised £138m in 2016, £125m in 2017 and £116m in 2019 and since listed on London Stock Exchange in September 2020 in an IPO worth £920m.

Key figures (2011 - 2020)

£2.4b

total equity investment

1,422

total deals

£1.7b

total tech equity investment

Deal numbers and value of equity investment to Manchester-based tech companies (2011–2020)

Spotlight Companies

2014

incorporated

106

employees

£65m

equity investment raised

Telcom Networks provides internet and phone line rental for businesses, individuals, and events. The company manages a suite of brands and divisions, all dedicated to the shared mission of delivering high-quality, value-for-money internet services for local communities. As well as providing internet services to businesses and the private rental sector, they also maintain full-stack infrastructure of full-fibre networks and provide engineering services.

In 2018, a collaboration between Telcom Networks and another Manchester-based fibre-network provider, The Loop, brought 10 gigabyte internet to 300 businesses in Manchester city centre. This initiative makes up part of a 10-year deal revolutionising internet utility in the city.

Shaun Gibson, CEO of Telcom Networks said: “We believe the internet should be offered as a utility, and this project is another step towards eliminating the digital divide once and for all in this region. We are very focused on digital inclusion and helping the independent creative community thrive. This is not a run-of-the-mill tech collaboration. It is in line with both the Government’s and the Mayor’s strategy and we’re proud to be supporting them on achieving their vision for the city region. What we’re doing here is just the start.”

Fixed-line; Website hosting or server provision services

2013

incorporated

80

employees

£58m

equity investment raised

The UK’s eHealth and digital medicine sector is thriving, and Push Doctor is another big player on the scene. Founded in 2013, Push Doctor claims to be the longest standing digital partner to the NHS. As well as providing on-demand online GP surgery appointments, its technology also assists surgeries in managing busy schedules and personalises the matching process between clinicians and patients; its Apollo programme links the NHS’s large and disparate databases.

Push Doctor has utilised extensive private investment on its growth journey, raising £58m in total from investors such as Draper Esprit, Oxford Capital Partners, and Celeres Investments. In 2019, it attended the DigitalHealth.London Accelerator, and in 2021, attended TechNation’s Future Fifty Accelerator.

After securing a £20m equity deal in 2017, Push Doctor has paid it forward to the Manchester eHealth scene, by investing £3m into a new digital health campus at its offices in the city centre. The company has also launched a grant scheme for student doctors; recipients receive a £500 grant to spend on university supplies, and a year’s free access to the Push Doctor Premium membership service.

Mobile apps; Personal healthcare services

Universities

The University of Manchester has spun out 53 companies, of which 46 remain active, in sectors including materials technology and clinical diagnostics.

One such spinout is drug developer F2G which has raised £136m in equity finance via eight rounds since incorporating in 1998. The company is based in the UK and Austria. It has been awarded four innovation grants totalling £3.3m.

Another notable spinout from the University of Manchester is Arvia Technology, which has developed technology to treat industrial wastewater. It has raised £18.4m of equity investment via six rounds and received 11 innovation grants worth a total of £1.1m.

Key stats

5

universities

83

spinouts

51

active spinouts

Manchester universities by number of spinouts created

Accelerators

As this graph shows, there is a strong positive correlation between accelerator attendance and equity investment in Greater Manchester. The skills and support that accelerators provide to founding teams are certainly catalysts for equity investment. Unfortunately, 2020 saw a significant decline in both equity investment and accelerator attendance in Greater Manchester. These declines are no doubt related to the pandemic and hopefully the 2021 figures will show a sharp reversal of these downtrends. However, as with Edinburgh, it is concerning that the pipeline of potential growth companies may be diminished due to the impact of the pandemic on accelerator activity.

Hopefully, the increased number of businesses started during the pandemic and efforts by local ecosystem players to promote entrepreneurship, including the local government, will translate into a new generation of high-growth companies.

Accelerator attendance and equity investment received by Manchester-based companies (2011–2020)

Incubators

Similar to those found in Edinburgh, incubators in Manchester are often linked to academic institutions or commercial hubs, helping to facilitate flows of knowledge and other key resources such as lab space.

Centrally located Innospace helps businesses to connect with the expertise and facilities available at Manchester Metropolitan University. Entrepreneurs and business leaders can choose from a range of services including office space, access to specialist tools such as the university’s 3D body scanner and food extrusion equipment, and assistance with startup visas for international founders.

Another important component of the Manchester ecosystem is the Tech Incubator at the Manchester Technology Centre. The incubator is hosted by Bruntwood SciTech and run in partnership with trade body Manchester Digital. The University of Manchester also operates a number of incubator spaces via the university’s Innovation Centre (UMIC). These include the biotech research and development centre at the Manchester Incubator Building and the Core Technology Building which offers lab modules and conferencing facilities.

Local government

While the majority of high-growth companies in Greater Manchester are located in the local authority area administered by the Manchester City Council, Greater Manchester’s ecosystem is supported by all of the component local authorities.

An example of collaboration between the councils and with private and academic partners is the Manchester Science Partnerships (MSP). MSP shareholders include Manchester City Council, Cheshire East Council, Salford City Council, the University of Manchester and Manchester University NHS Foundation Trust. The partnership is focused on supporting the local knowledge and technology ecosystem via two campuses, Citylabs and Manchester Science Park which are run by shareholder and property company Bruntwood SciTech.

Another important role played by local government is inward investment and economic development. Greater Manchester is served by MIDAS which is wholly owned by the Greater Manchester Combined Authority. MIDAS assists national and international companies in sourcing property, recruiting and training employees, and understanding investment opportunities.

Manchester City Council has also selected a consortium led by Barclays Eagle Labs to operate the new Manchester Digital Innovation and Security Hub (DISH) due to be up and running in 2022. The Manchester Digital Security Innovation Hub is supported by Greater Manchester Combined Authority through the Local Growth Fund.

"Manchester was recently named one of the most innovative cities in the world. Our growing status as the UK’s hotbed for innovation has seen us become a destination of choice for life sciences, digital development, financial services, manufacturing and education."

Tim Newns,

CEO, MIDAS

Topic

Related tags